Are you tired of living paycheck to paycheck, constantly worrying about how to make ends meet? Do you dream of achieving financial stability and freedom? You’re not alone! Creating a budget that works for you can seem daunting, but with these practical tips and strategies, you’ll be on your way to mastering the art of budgeting.

Why Budgeting is Essential

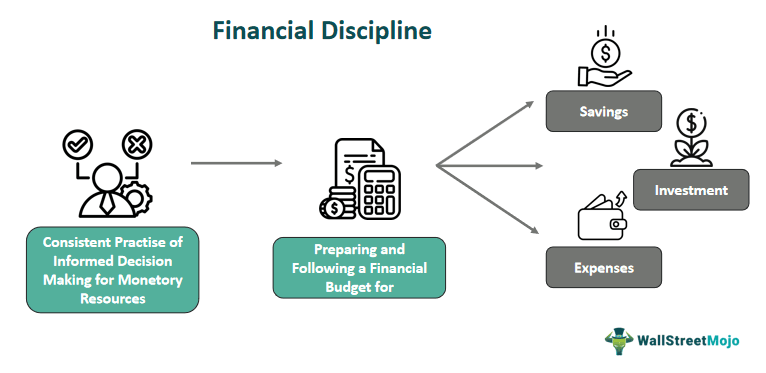

Budgeting is more than just managing your money; it’s about creating a financial safety net that allows you to breathe easily, make smart investments, and enjoy life without financial stress. By having a solid budget in place, you’ll be able to:

* Pay off debt faster

* Build savings and emergency funds

* Invest in your future

* Enjoy the freedom to pursue your passions

Step 1: Track Your Expenses

Before creating a budget, it’s essential to understand where your money is going. For one month, write down every single transaction, no matter how small. This will give you a clear picture of your spending habits and help you identify areas for improvement.

Example:

* Rent: $1,500

* Utilities: $150

* Groceries: $800

* Entertainment: $500

Step 2: Categorize Your Expenses

Divide your expenses into categories, such as housing, transportation, food, entertainment, and savings. This will help you prioritize your spending and make informed decisions.

Example:

* Housing (30%): Rent, utilities, maintenance

* Transportation (10%): Car loan, insurance, gas

* Food (15%): Groceries, dining out

Step 3: Set Financial Goals

Determine what you want to achieve with your budget. Do you want to pay off debt? Build an emergency fund? Invest in a retirement account?

Example:

* Short-term goal: Pay off $5,000 of credit card debt within the next six months

* Long-term goal: Save $10,000 for a down payment on a house

Step 4: Create a Budget Plan

Based on your income, expenses, and financial goals, create a budget plan that allocates your money accordingly.

Example:

* Income: $4,000 per month

* Fixed expenses (housing, utilities, transportation): $2,500

* Variable expenses (food, entertainment): $1,200

* Savings and debt repayment: $500

Step 5: Monitor and Adjust

Regularly review your budget to ensure you’re on track to meet your financial goals. Make adjustments as needed to stay on course.

Example:

* Month 3: Pay off credit card debt in full

* Month 6: Increase savings rate by 10%

Additional Budgeting Tips

* Use the 50/30/20 rule: Allocate 50% of your income towards fixed expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

* Consider using a budgeting app or spreadsheet to track your finances and stay organized.

* Prioritize needs over wants – be honest with yourself about what you can live without.

Conclusion

Budgeting is not just about numbers; it’s about creating a financial safety net that allows you to live the life you want. By following these practical tips and strategies, you’ll be well on your way to achieving financial stability and freedom. Remember, budgeting is an ongoing process – stay flexible, adjust as needed, and watch your finances thrive!

omg yaaas this tip about creatin a 50/30/20 budget is LIFE.CHANGING. been struggling w/ overspending and its literally saved me $$$

Lmao just spent my whole paycheck on avocado toast and now i’m lowkey broke can anyone pls share ur fave budgetin tips??!

omg yaaas budgetin tips are life i just started trackin my expenses and ive already saved like 50 bucks its so crazy how much money u can save with a lil bit of planning

omg yessss budgeting tips r lifesavers!! just started trackin my expenses with an app and its been so liberatin i can finally afford those avocado toast Tuesdays

olixjlhxdtqrrljngtjxkrjopuixxn

rtejdznyslqoifsfrvdurwxvuwnmml

vkwqxofrnowvxwvjeknnuygxytqtys

https://shorturl.fm/tOoS8

https://shorturl.fm/E0888

https://shorturl.fm/YXvkV

https://shorturl.fm/k17iJ

Нужен сантехник: сантехник на дом срочно

Онлайн авто портал https://avtomobilist.kyiv.ua с обзорами новых и подержанных авто, тест-драйвами, советами по обслуживанию и новостями из мира автопрома.

Онлайн женский https://ledis.top сайт о стиле, семье, моде и здоровье. Советы экспертов, обзоры новинок, рецепты и темы для вдохновения. Пространство для современных женщин.

I believe you have remarked on some very interesting points , thankyou for the post.

https://shorturl.fm/vmU3F

Are grateful for this blog post, it’s tough to find good information and facts on the internet

https://shorturl.fm/VyyOs

Saw your material, and hope you publish more soon.

You are not right. I am assured. I can prove it. Write to me in PM, we will talk.